Facilitating partnerships between US innovation and Middle Eastern capital

Recent Success: Helped a US fintech company secure $25M Series B from Abu Dhabi sovereign fund. Total time from introduction to term sheet: 73 minutes.

Private sessions with fund managers who deploy $10-50M quarterly. Value: $150,000

First look at opportunities 6-18 months before US market. Value: $100,000

Navigate relationship-first investment protocols. Value: $50,000

Behind-the-scenes meetings with regional power players. Value: $25,000

Early adopter advantage in Middle Eastern co-investments

Mainstream awareness begins

Competition for access intensifies 10x

Geographic arbitrage opportunity disappears

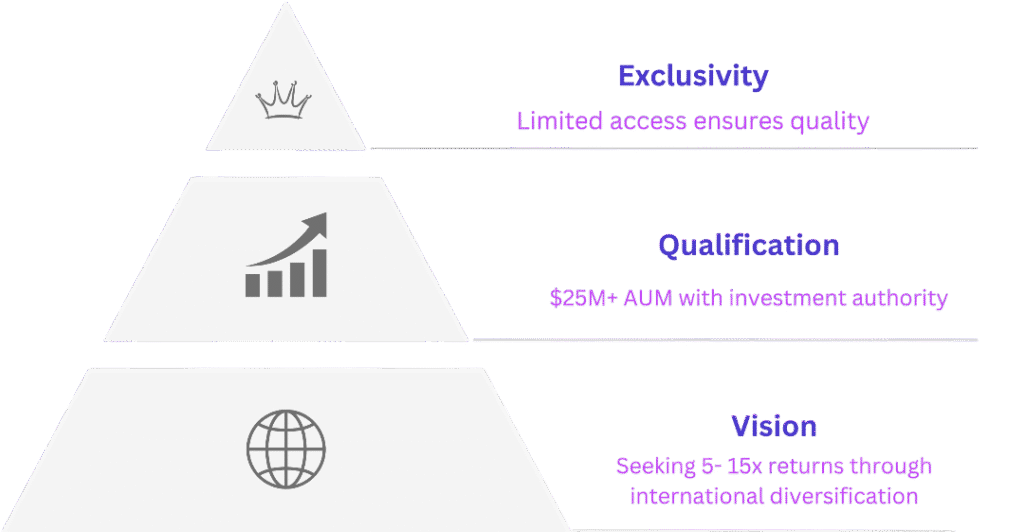

Complete confidential application for consideration

Applications reviewed within 24 hours

Qualified investors contacted directly for private discussion

Ghani Consulting maintains fiduciary responsibility to our sovereign wealth fund partners, ensuring all introduced investors meet their strict qualification criteria.

Our track record shows deals can move extremely quickly – as fast as 73 minutes from introduction to term sheet for qualified opportunities with the right partners.

[forminator_form id="1175"]